Loading

Get Canada T400a 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T400A online

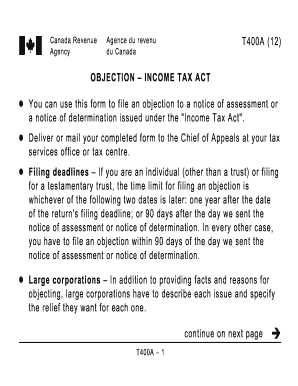

The Canada T400A form is used to file an objection under the Income Tax Act regarding a notice of assessment or determination. This guide will provide you with clear, step-by-step instructions to fill out the T400A efficiently online.

Follow the steps to complete your T400A form online.

- Click ‘Get Form’ button to access the form and open it in your selected editor.

- Provide your personal information in the 'From' section, including your name, address, city, province or territory, postal code, and telephone number. Ensure all information is accurate as this will be used for correspondence.

- If applicable, include the name and address of any authorized representative in the designated section. This should include their contact information to facilitate communication.

- Enter the address of the Chief of Appeals as it appears on your notice. Be careful to input the correct city, province or territory, and postal code.

- In the ‘Notice information’ section, provide the date of the notice, the number of the notice (found on the notice itself), the relevant tax year, and your social insurance number or business number.

- Articulate the relevant facts and reasons for your objection in the provided space. If more space is needed, attach an additional sheet. Be clear and concise in your explanation to support your case.

- Sign and date the form. If you are submitting the objection on behalf of a corporation or trust, ensure it is signed by an authorized person.

- Finalize your form by reviewing all entries for accuracy. Once confirmed, you can save your changes, download, print, or share the completed T400A form.

Complete your Canada T400A form online today for a smooth objection process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

In Canada, a T4 slip is issued by employers to report employment income, and there is no specific income threshold for receiving one. If you earn wages, salaries, or bonuses, you will likely receive a T4 slip from your employer at the end of the tax year. Keeping track of your income, especially for tax documents like the Canada T400A, is essential to maintain accurate records.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.