Loading

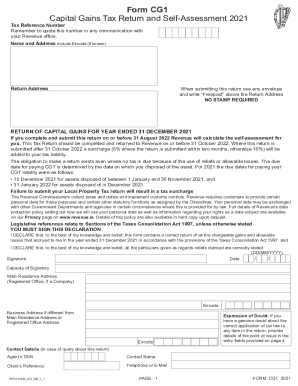

Get Pdf Form Cg1capital Gains Tax Return 2021 - Revenue

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PDF Form CG1 Capital Gains Tax Return 2021 - Revenue online

Filing your Capital Gains Tax Return is an essential obligation for taxpayers. This guide provides clear and detailed steps to help users complete the PDF Form CG1 Capital Gains Tax Return 2021 accurately and efficiently.

Follow the steps to successfully complete your tax return.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your tax reference number in the designated field. This number is crucial for all communications with the Revenue office.

- In the Return Address section, write 'Freepost' above the return address when you are ready to submit. Remember, no stamp is required.

- Complete the Return of Capital Gains section for the year ending 31 December 2021, ensuring to submit the return by 31 October 2022 to avoid any surcharges.

- Record a detailed account of all capital gains and allowable losses in the specific sections for each asset type, including unquoted shares, land, and other specified properties.

- Indicate any claim for reliefs by checking the corresponding boxes and entering the relevant amounts for the disposal of specific assets, like the principal private residence.

- Finally, review all entries for accuracy, save your changes, and proceed to download, print, or share the completed form.

Complete your Capital Gains Tax Return online today for a smooth filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

9 Ways to Avoid Capital Gains Taxes on Stocks Invest for the Long Term. ... Contribute to Your Retirement Accounts. ... Pick Your Cost Basis. ... Lower Your Tax Bracket. ... Harvest Losses to Offset Gains. ... Move to a Tax-Friendly State. ... Donate Stock to Charity. ... Invest in an Opportunity Zone.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.