Loading

Get Canada T1135 E 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T1135 E online

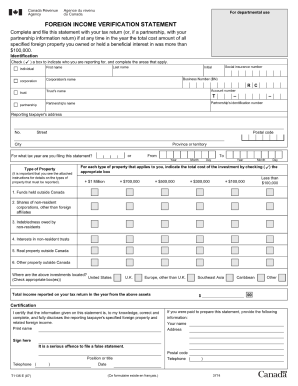

The Canada T1135 E is a crucial form for individuals holding foreign income and assets. Understanding how to accurately fill out this document online can help ensure compliance with Canadian tax laws.

Follow the steps to complete the Canada T1135 E online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal information in section 1, which includes your name, address, and taxpayer identification number. Ensure all details are correct to avoid processing delays.

- In section 2, you will need to specify the fiscal year for which you are reporting your foreign income or assets. Make sure to indicate the correct year.

- Next, move on to section 3, where you will list each foreign property you own. Include details such as the country where the property is located, the type of asset, and the maximum value during the reporting period.

- Proceed to section 4 to disclose any foreign bank accounts. You should provide the account numbers and the financial institution's name, along with the highest balance held in each account during the year.

- Once all sections are filled out, review your information for accuracy. It is important that all entries reflect your actual holdings and are clearly stated.

- Finally, after verifying all your entries, you can save changes to your form. Options to download, print, or share the completed document will be available for your convenience.

Take the next step and complete your documents online to ensure proper compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

When a Canadian sells a house in the USA, they must consider potential capital gains taxes in both countries. The IRS may require withholding tax on the sale, and you'll need to file appropriate tax returns in both Canada and the US. It's wise to consult a tax professional to navigate obligations related to Canada T1135 E.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.