Loading

Get Canada T1134-b E 1999-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T1134-B E online

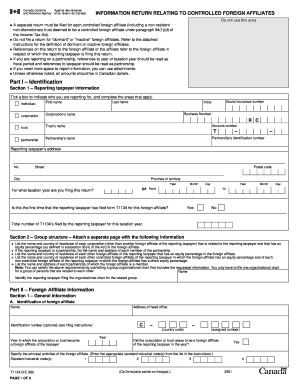

Completing the Canada T1134-B E form is essential for reporting controlled foreign affiliates. This guide provides a detailed, step-by-step approach to help users efficiently navigate and complete the form online.

Follow the steps to fill out the Canada T1134-B E form online.

- Press the ‘Get Form’ button to obtain the form and open it in the editor.

- In Part I, Section 1, provide the reporting taxpayer information. Indicate your status by ticking the applicable box (individual, corporation, trust, or partnership) and fill out the required personal details such as last name, first name, and relevant identification numbers.

- Still in Part I, Section 1, specify the reporting taxpayer's address, including street number, postal code, city, and province or territory. Indicate the taxation year for which you are filing the return.

- In Part I, Section 2, outline the group structure related to the reporting taxpayer. Attach a detailed organizational chart or list the names and countries of residence of related corporations or partnerships.

- Move to Part II, Section 1, and complete the general information for the foreign affiliate. Provide details like the name, address of the head office, and the year it became a foreign affiliate.

- Continue in Part II with Section 2 where you need to report financial information about the foreign affiliate. Attach unconsolidated financial statements or any other available financial information.

- In Section 3 of Part II, provide information related to surplus accounts, specifying any dividends received and the relevant surplus accounts involved.

- In Part III, Section 1, count the number of full-time employees engaged by the foreign affiliate on a business basis, and report this accurately.

- Finish by verifying all provided information across sections, making any necessary corrections. Finally, proceed to save changes, download a copy, print, or share the completed form as needed.

Complete your Canada T1134-B E form online today and ensure compliance with tax regulations.

Yes, Canadians may need a W-8BEN form when receiving income from U.S. sources to certify their foreign status and claim reduced withholding tax rates. It is an important document used to establish that you are not a U.S. taxpayer. For any uncertainties in the form's completion, US Legal Forms offers accessible templates and instructions tailored for Canadians.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.