Get Canada T1013 E 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T1013 E online

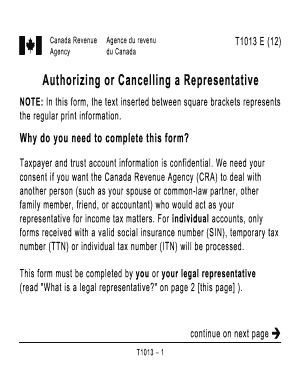

The Canada T1013 E form is essential for individuals wishing to authorize a representative to manage their income tax matters with the Canada Revenue Agency (CRA). This guide will provide you with comprehensive steps to fill out the form efficiently online, ensuring that you provide the necessary information accurately.

Follow the steps to complete the T1013 E form online.

- Click ‘Get Form’ button to obtain the T1013 E form and open it in the online editor.

- Enter your taxpayer information in Part 1. This includes your first name, last name, telephone number, and one of the following: your social insurance number (SIN), temporary tax number (TTN), individual tax number (ITN), trust account number, or T5 filer identification number.

- Choose the appropriate section for giving consent to a representative. You can select Part 2 for online access or Part 3 for other access.

- If you selected Part 2, enter your representative's identification number (RepID, GroupID, or business number) and their name. Specify the level of authorization you wish to grant.

- If you selected Part 3, complete the representative's name and indicate the level of authorization and the tax year(s) for which consent is granted.

- In Part 4, you can specify an expiry date for the consent if desired. Otherwise, it will remain in effect until cancellation.

- If you need to cancel an existing consent, complete Part 5. Choose whether to cancel all consents or just those for a specific representative.

- Finally, sign and date the form in Part 6. Ensure that your signature is present; otherwise, the form cannot be processed.

- Once you have completed all required sections, save any changes, download a copy of the completed form, and prepare to submit it to your CRA tax centre.

Ensure your tax affairs are in order by completing the Canada T1013 E form online today.

Get form

Yes, interpreters are in demand in Canada due to the country's multicultural landscape and the need for effective communication across diverse languages. Industries such as healthcare, legal, and government frequently seek the expertise of professional interpreters. As the requirement for precise translations grows, understanding the significance of accurate services related to Canada T1013 E becomes ever more important.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.