Get Canada T1 General 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T1 General online

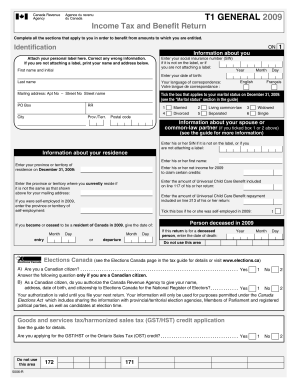

Filling out the Canada T1 General form can seem daunting, but understanding its components and following a clear process can make it manageable. This guide will provide you with detailed instructions for completing the form online, ensuring you accurately report your income and claim your benefits.

Follow the steps to successfully complete your Canada T1 General online.

- Press the ‘Get Form’ button to acquire the form and open it in your editor.

- Begin with the identification section. Attach your personal label if available; otherwise, clearly print your first name, last name, and mailing address.

- Provide your social insurance number (SIN) and date of birth in the appropriate fields. Select your language of correspondence from the options provided.

- Indicate your marital status by ticking the appropriate box for your situation as of December 31, 2009.

- If applicable, fill in the information about your spouse or common-law partner, including their SIN and net income for 2009, ensuring to include any Universal Child Care Benefits.

- Complete the residence section by specifying your province or territory of residence and any relevant dates if you became or ceased to be a resident during the year.

- Report your total income in the dedicated section, making sure to sum all types of income, including employment, pensions, and self-employment income.

- Calculate your net income by filling in deductions applicable to you, such as pension adjustments and child care expenses, following the guide for instructions.

- Determine your taxable income by subtracting allowable deductions from your net income.

- Proceed to the refund or balance owing section. Calculate your federal and provincial taxes owed, in addition to any potential credits.

- Once you have completed the form, save your changes, and consider downloading or printing a copy for your records.

Start completing your Canada T1 General online today for a smoother tax filing experience.

Get form

The T1 tax form is the primary document used by individuals to report their income and calculate taxes owed or refunds due to the CRA. This form includes various sections that cover different types of income, deductions, and credits. Completing the Canada T1 General accurately is crucial to ensure you fulfill your tax obligations and potentially receive a refund. Many use online platforms like uslegalforms for ease of use in obtaining and filing this form.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.