Loading

Get Canada T1 General 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T1 General online

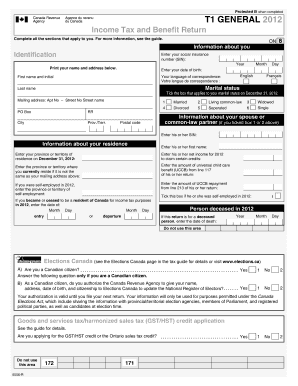

Filing your income tax return online can simplify the process and ensure accuracy. This guide provides clear, step-by-step instructions on how to complete the Canada T1 General form, tailored to users of all experience levels.

Follow the steps to successfully complete your tax return online.

- Click ‘Get Form’ button to obtain the Canada T1 General and open it in your preferred online editor.

- Fill in your identification details, including your social insurance number (SIN), your full name, and your mailing address. Ensure that the information reflects your residency as of December 31 of the tax year.

- Indicate your marital status as of December 31 by ticking the appropriate box.

- If applicable, provide details regarding your spouse or common-law partner, including their SIN, name, and net income for the year.

- Complete the section asking about your residence and any self-employment details if relevant.

- Report your total income by including all applicable income sources as listed in the income section, including employment income and benefits.

- Calculate your net income by entering deductions, such as pension adjustments and child care expenses, as indicated on the form.

- Determine your taxable income by applying any additional deductions specified in the form.

- Calculate your total taxes owed and any credits that apply to you. Consider using the guides provided for each section to ensure accuracy.

- Review all entries for completeness and accuracy before saving your changes.

- Once satisfied, save your document and consider downloading, printing, or sharing the completed form as necessary.

Start completing the Canada T1 General online to ensure a smooth and timely filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The $1000 welcome to Canada bonus is available for eligible newcomers who are recent immigrants with low income. This bonus aims to provide financial support as you settle into your new life in Canada. To be eligible, you must meet specific requirements regarding residency and income. Keep in mind that understanding these conditions can be beneficial when you file your Canada T1 General tax return.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.