Loading

Get Canada Rc66 E 2003

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada RC66 E online

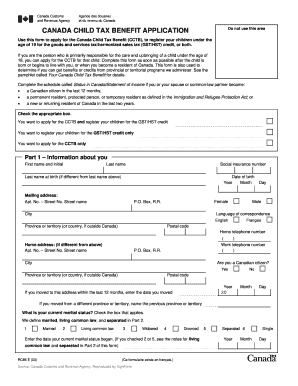

The Canada RC66 E form is crucial for individuals applying for the Canada Child Tax Benefit and registering their children for the GST/HST credit. This guide will provide clear and detailed instructions on how to effectively complete this form online, ensuring a smooth and accurate submission process.

Follow the steps to successfully complete the Canada RC66 E form online.

- Press the ‘Get Form’ button to access the Canada RC66 E form so you can begin completing it online.

- Provide your personal information in Part 1, which includes your first name, last name, social insurance number, date of birth, mailing address, and marital status. Ensure that all fields are filled out accurately to avoid delays.

- If applicable, complete Part 2 with information about your spouse or common-law partner, including their first name, last name, social insurance number, and date of birth.

- In Part 3, input details about each child for whom you are applying. You will need to provide each child's first name, last name, place of birth, and date of birth. Make sure to include details on whether you have been primarily responsible for the child since birth.

- Complete Part 4 if there has been a change in caregiving for the child, ensuring you include the previous caregiver's information and secure their signature if possible.

- In Part 5, certify the accuracy of the information provided by signing the form. If married or living common-law, your partner must also sign.

- If opting for direct deposit, complete Part 6 with your banking information or attach a voided cheque. This will facilitate faster processing of any payments.

- Finally, review your form using the checklist provided to ensure all necessary sections are completed and required documents are attached. Save your changes, then download or print your completed form for submission.

Complete your Canada RC66 E form online today to apply for your benefits efficiently.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The new $7500 tax credit in Canada is designed to offer financial relief for eligible taxpayers. This credit can help reduce your tax payable when you file your annual returns. Make sure to check the eligibility criteria to take advantage of this benefit. Using the Canada RC66 E form can help you claim this tax credit efficiently.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.