Loading

Get Tx Form 624 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Form 624 online

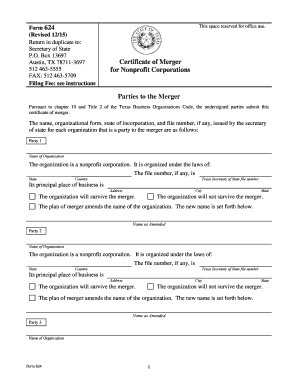

Filling out the TX Form 624 online can be a straightforward process when you have clear guidance. This form is essential for nonprofit corporations looking to effect a merger in accordance with Texas law. This guide offers step-by-step instructions to assist users in completing the form accurately and efficiently.

Follow the steps to fill out the TX Form 624 online.

- Use the ‘Get Form’ button to retrieve the form and open it in your preferred online platform.

- Enter the details for each party involved in the merger, including the name, organizational form, and jurisdiction of formation. If a name change is involved, indicate the current name and the new amended name.

- Attach the plan of merger as required under section 10.002 of the Texas Business Organizations Code, or alternatively, complete the Alternative Statements section if applicable.

- If amendments are included in the plan, select the appropriate options from Items 3A to 3D concerning changes made to the certificate of formation of any surviving entity.

- List each new nonprofit corporation that will be created by the merger, providing the legal name, jurisdiction, description of the organization, and the principal place of business.

- Ensure that the approvals required by the governing documents and laws of each organization are documented concerning the plan of merger.

- Select the effectiveness of filing option that applies, whether it should take effect upon acceptance, at a delayed date, or upon a future event.

- Include the tax certificate from the Texas Comptroller of Public Accounts to confirm all franchise taxes have been paid by the non-surviving entity.

- Each party to the merger must sign the certificate, certifying its accuracy, and include the printed name and title of the authorized signatory.

- After completing all sections, review the form for accuracy. Save changes, download the form, print it, or share it as required.

Start completing your TX Form 624 online today to facilitate your nonprofit merger.

To start a nonprofit in Texas, you must file for a Certificate of Formation (Form 202), which requires a $25 filing fee. However, to run a nonprofit in Texas, you must also file other paperwork on a federal level that will run up costs. Federal tax-exempt filings can cost between $275 and $600 in filing fees.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.