Get Canada Gst66 E 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada GST66 E online

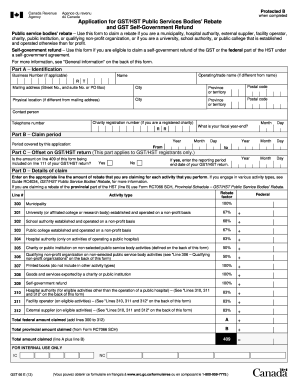

This guide will assist you in completing the Canada GST66 E form, which is used to apply for the GST/HST Public Services Bodies' Rebate and the GST Self-Government Refund. By following the steps outlined here, you will navigate the form efficiently and accurately.

Follow the steps to complete the Canada GST66 E form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Part A, provide identification details including your Business Number if applicable, operating or trade name, full name, mailing address, and physical location details if different from your mailing address. Also, include contact information and charity registration number if you are a registered charity.

- In Part B, indicate your claim period by entering the relevant year and the period covered by this application using the month and day formats.

- In Part C, for GST/HST registrants only, answer whether the amount on line 409 is included on line 111 of your GST/HST return, and if so, enter the reporting period end date.

- In Part D, specify the amount of rebate you are claiming for each activity performed. Refer to the designated activity types and their associated federal factors to ensure accurate entries.

- Calculate and enter the total federal amount claimed as well as any provincial amount if applicable. Sum these to arrive at the total amount claimed on line 409.

- In Part E, certify the information by printing your name, title, and signing the form, while also including a contact telephone number and the date.

- Review all sections for completeness and accuracy before saving changes, downloading, printing, or sharing the form.

Complete your Canada GST66 E form online to ensure a smooth submission process.

Get form

Seeing 'Canada' on your bank statement likely refers to a transaction or deposit originating from a Canadian entity. This could represent a payment received from a Canadian company, government, or even cross-border transactions. It’s important to identify the source of these funds for effective record-keeping. If you need help interpreting your bank statement or managing finances, uslegalforms provides various financial tools.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.