Get Canada Gst66 E 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada GST66 E online

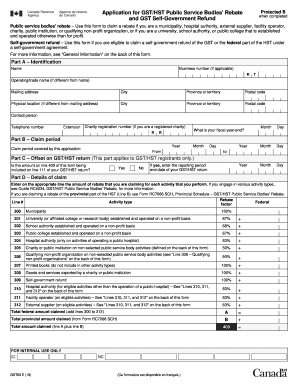

The Canada GST66 E form is designed for public service bodies to claim rebates on their GST/HST expenses. This guide will help you navigate through the various sections and fields of the form, ensuring you have all the necessary information for successful completion.

Follow the steps to effectively complete the Canada GST66 E form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Part A – Identification. Fill in your name, business number (if applicable), operating/trade name, mailing address, and physical location. Ensure you include the city, province or territory, postal code, and a contact person's name and telephone number.

- Indicate your charity registration number if you are a registered charity. Specify your fiscal year-end by entering the month, day, and year.

- Proceed to Part B – Claim period. Identify the year and provide the claim period covered by this application by entering the start and end date.

- Move on to Part C – Offset on GST/HST return. If you are a GST/HST registrant, indicate whether the amount on line 409 of this form will be included on line 111 of your GST/HST return by selecting 'Yes' or 'No.' If 'Yes,' provide the reporting period end date.

- In Part D – Details of claim, enter the amounts for various activities and ensure they align with the appropriate activity type. Review the guide RC4034 for further clarification on each activity.

- Finally, in Part E – Certification, certify that all provided information is accurate. Print your name, title, sign the form, and fill in your telephone number and extension.

- Once finished, save changes, download, print, or share your completed Canada GST66 E form as needed.

Complete your documents online for a streamlined filing experience.

Get form

Receiving a payment from Canada may occur for various reasons, such as a tax refund or a payment from a service provider. If you applied for a GST refund, the payment could be related to your approved Canada GST66 E application. Tracking these payments ensures a clear understanding of your finances. If you still have questions about the source, checking your records or contacting your bank can provide further assistance.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.