Loading

Get In State Form 51781 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN State Form 51781 online

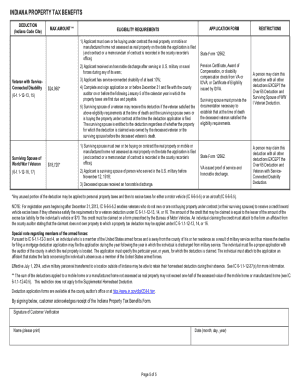

This guide provides clear instructions for users on how to complete the IN State Form 51781 online. The form is essential for claiming property tax benefits in Indiana, and understanding each section will help ensure that the application is filled out correctly.

Follow the steps to fill out the IN State Form 51781 online.

- Click the ‘Get Form’ button to access the IN State Form 51781 and open it for editing.

- Begin by entering your personal information in the designated fields. This typically includes your full name, address, and contact details. Ensure accuracy as this information is crucial.

- Identify the property for which you are claiming the tax benefits. Provide details such as the property address and any identifying numbers, like parcel numbers.

- Review and select the appropriate tax deductions you are applying for. There are various deductions available based on your eligibility, so refer to the instructions for each one.

- Fill out the eligibility requirements section by providing the necessary information that proves your eligibility for each selected benefit. This may include income details and property ownership verification.

- Complete any additional documentation required based on the benefits you are claiming. This might involve attachments of proof or supplementary forms.

- Review your completed form for any errors or omissions before finalizing it. Ensure that all required fields are filled out correctly.

- Once satisfied with the content, save your changes, and take a moment to download or print the form. Alternatively, if required, share the form with the relevant authorities.

Complete your IN State Form 51781 online to take advantage of available property tax benefits.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Paperwork. Homeowners must fill out a claim for homestead property tax standard/supplemental deduction, State Form 5473. The form must be filled out each time the property title changes, including for the transfer of your property into your trust.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.