Get Ca T2 Sch 546 E 2010-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA T2 SCH 546 E online

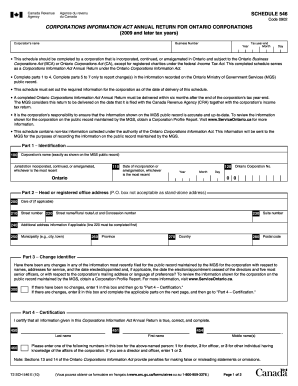

This guide provides a comprehensive walkthrough for completing the CA T2 SCH 546 E, the Corporations Information Act Annual Return for Ontario Corporations. Designed for both new and experienced users, this resource will help ensure you accurately fill out the form online.

Follow the steps to fill out the CA T2 SCH 546 E online.

- Press the ‘Get Form’ button to access the CA T2 SCH 546 E and open it for editing.

- Begin with Part 1 — Identification. Enter the corporation's name exactly as it appears on the Ministry of Government Services public record. Fill in the jurisdiction of incorporation or amalgamation, and provide the date of incorporation or amalgamation.

- Move to Part 2 — Head or registered office address. Do not use a P.O. box as a stand-alone address. Fill in the care of (if applicable), street number, street name, municipality, province, country, and postal code.

- In Part 3 — Change identifier, indicate if there have been any changes in the information most recently filed. Enter '1' if there are no changes, or '2' if changes have occurred and proceed to the applicable parts.

- Proceed to Part 4 — Certification. Certify that all information provided is true, correct, and complete by filling out the required name and title fields.

- If applicable, complete Parts 5, 6, and 7 for reporting changes in mailing addresses or director/officer information. Fill in the necessary fields as instructed.

- Once all necessary parts are completed, review the form for accuracy. Save any changes made, and download or print the form as needed. Share it accordingly to meet the filing requirements.

Complete your forms online today to ensure timely and accurate submission.

In Canada, corporations must file a T2 return, including those operating as non-profits and inactive corporations. The requirement applies federally regardless of revenue or size. If your corporation falls under specific categories, including those that may use forms like CA T2 SCH 546 E, understanding your obligations is crucial. Using services from uslegalforms can help clarify these requirements and guide you through the filing process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.