Loading

Get Canada Td2r 2003-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada TD2R online

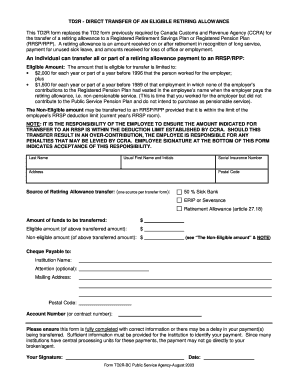

The Canada TD2R form is essential for the transfer of a retiring allowance to a Registered Retirement Savings Plan or Registered Pension Plan. This guide provides you with step-by-step instructions on how to complete the form online effectively.

Follow the steps to properly complete the Canada TD2R form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in your last name, usual first name, and initials as requested in the designated fields.

- Enter your Social Insurance Number in the appropriate section to verify your identity.

- Provide your address and postal code to ensure correct communication regarding your transfer.

- Select the source of the retiring allowance transfer from the options provided: 50% Sick Bank, ERIP or Severance, or Retirement Allowance (article 27.18).

- Indicate the total amount of funds to be transferred by entering the appropriate dollar amount.

- Calculate and fill in the eligible amount from the funds specified above.

- Determine and record the non-eligible amount based on the outlined guidelines.

- Specify the institution name that the cheque should be payable to, along with any optional attention line.

- Fill in the mailing address and postal code for the institution to ensure proper delivery.

- Enter the account number or contract number relating to your transfer.

- Double-check all the information entered to avoid delays in processing.

- Provide your signature in the designated area to indicate acceptance of responsibility for the accuracy of the information provided.

- Enter the date of signing to finalize your submission.

- After completing the form, save changes, download, print, or share the document as needed.

Complete your documentation online to ensure efficient processing of your retiring allowance transfer.

The total time to obtain Canadian citizenship can vary, but typically it takes about 3 to 5 years, including the time spent as a permanent resident. Processing times may also be influenced by application satisfaction and individual circumstances. Checking uslegalforms can help you stay organized and informed about current processing timelines.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.