Loading

Get Canada Sc Isp-1901 E 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada SC ISP-1901 E online

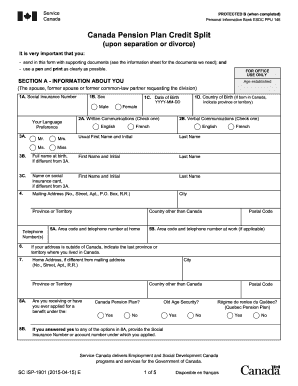

The Canada SC ISP-1901 E form is essential for individuals seeking a credit split under the Canada Pension Plan following a separation or divorce. This guide provides a step-by-step approach to filling out the form online, ensuring you have all necessary information at hand for a smooth submission process.

Follow the steps to complete the Canada SC ISP-1901 E online

- Click the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- In Section A, provide your personal information, including your Social Insurance Number, date of birth, and mailing address. Ensure that you print clearly.

- In Section B, enter the information for your spouse or former partner, including their Social Insurance Number and other required personal details.

- If the credits to be divided were accumulated during a legal marriage, complete Section C by providing details about your marriage date, where it occurred, and last cohabitation.

- If applicable, fill out Section D, which deals with a common-law union, by providing the relevant dates and addressing any periods of separation.

- Section E requires information about any written agreements or court orders concerning the division of pension credits, if applicable.

- Identify your status in Section F, specifying if you are the person named in Section A or acting on their behalf.

- Complete Section H by signing the declaration to confirm that the information provided is accurate. Be aware of the implications of providing false information.

- If signing with a mark, ensure a witness completes Section I with their details to validate the signature.

- Once all sections are filled out, review for accuracy, save your changes, and prepare to download, print, or share the completed form as needed.

Start filling out your Canada SC ISP-1901 E online today for a seamless experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, under certain conditions, you may be entitled to a portion of your ex-husband's CPP benefits after divorce. The Canada SC ISP-1901 E rules address this matter, ensuring equitable distribution of pension rights. Consulting with a legal professional can help you navigate your entitlements and secure your financial future.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.