Loading

Get Canada Fsco 5.2 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada FSCO 5.2 online

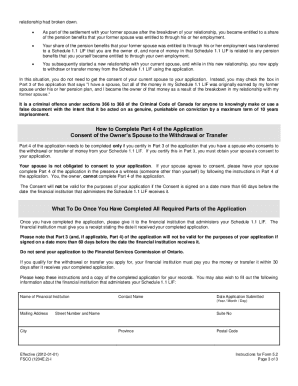

This guide provides clear and supportive instructions for completing the Canada FSCO 5.2 form, necessary for those wishing to withdraw or transfer funds from their Ontario life income fund. Understanding each component of the application will help ensure a smooth and successful submission.

Follow the steps to complete your application efficiently.

- Press the ‘Get Form’ button to access the Canada FSCO 5.2 application and open it for editing.

- Fill in your personal information in Part 1, including your full name, date of birth, and contact information. Make sure to provide the name and address of the financial institution administering your Schedule 1.1 LIF, along with the relevant account or policy number.

- In Part 2, indicate the date the money was transferred into your Schedule 1.1 LIF and detail the transferred amount. Specify how much you wish to withdraw or transfer, ensuring that it does not exceed 50% of the transferred amount.

- Choose whether you want to withdraw all the money or transfer it to an RRSP or RRIF. If transferring, provide the necessary details about the RRSP or RRIF.

- Complete Part 3 by certifying the application in the presence of a witness. Choose the appropriate statement regarding your marital status and ensure the certification is dated correctly.

- If your spouse's consent is needed, have them complete Part 4 in front of a witness, ensuring they understand their rights and the legal implications of signing.

- Once all parts are completed, submit the application directly to the financial institution that manages your Schedule 1.1 LIF and retain a copy for your records.

Begin filling out your Canada FSCO 5.2 form online today to manage your funds effectively.

The rules for LIF in Ontario are set forth by Canada FSCO 5.2 and include restrictions on withdrawals, investment options, and minimum payout requirements. It's essential to understand these regulations to manage your retirement funds effectively. Always consult with a financial advisor to navigate the complex rules surrounding LIFs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.