Get Canada 2129k (97-12)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada 2129K (97-12) online

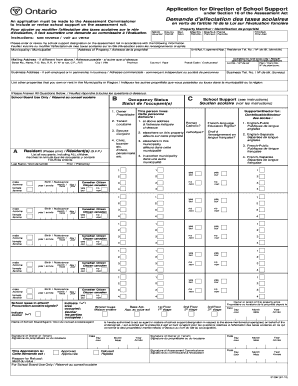

Completing the Canada 2129K (97-12) is essential for users seeking to declare or adjust their school support on the assessment roll. This guide provides a clear, step-by-step approach to assist users of all backgrounds in successfully filling out this online form.

Follow the steps to complete the Canada 2129K (97-12) form efficiently.

- Press the ‘Get Form’ button to access the Canada 2129K (97-12) form and open it for editing.

- Begin by providing your Property Identifier, including County, Neighborhood, Municipality, and Map Sections. Ensure all details are accurate.

- Fill in your personal information including your full address, mailing address (if different), and contact details. If the property is located in a rural area, complete the relevant section.

- Indicate your Occupancy Status by selecting whether you are an owner, tenant, or spouse and specify their living arrangements.

- List all occupants of your household, ensuring to include the last name, first name, and birth details for each individual, including children.

- Answer the questions related to Canadian citizenship and education rights, choosing 'yes' or 'no' as appropriate.

- Specifically, indicate your school board preferences from the options provided, including whether you prefer English or French language boards.

- Complete all necessary signatures, including those of the owner or tenant and the Assessment Commissioner if applicable.

- Review all entered information for accuracy, then save your changes. You may download, print, or share the form as needed.

Complete your Canada 2129K (97-12) application online to ensure your school support is accurately represented.

When filling out a W8BEN form in Canada, ensure you begin by clearly stating your full name and address. It's crucial to include your country of citizenship and, if relevant, your Canadian tax identification number. Highlighting your foreign status helps the IRS recognize your eligibility for tax treaty benefits, particularly concerning the Canada 2129K (97-12). Resources provided by USLegalForms can further simplify your experience with this form.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.