Loading

Get Wa 84 0001a 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WA 84 0001a online

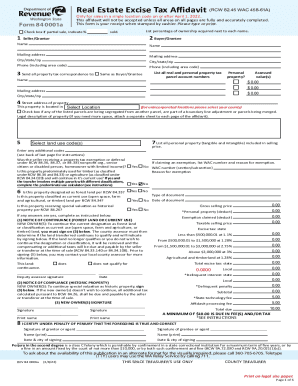

The WA 84 0001a form, also known as the Real Estate Excise Tax Affidavit, is essential for reporting real estate transactions in Washington State. This guide will provide clear, step-by-step instructions on how to accurately complete the form online, ensuring all required sections are properly filled.

Follow the steps to complete the WA 84 0001a online.

- Select the ‘Get Form’ button to access the WA 84 0001a form and open it in your preferred editor.

- Begin by reviewing the top section, ensuring to check the box if it is a partial sale and indicating the percentage sold. Accurately list the names of all sellers and buyers as they appear on the legal conveyance document.

- Fill in the mailing addresses for both the buyer and the seller, including their city, state, and zip codes, along with contact phone numbers.

- Designate the address for sending property tax correspondence and list all relevant property tax parcel account numbers. Indicate whether personal property is part of the sale, including assessed values.

- In Section 4, enter the street address of the property and any additional legal descriptions if space is insufficient.

- Select the appropriate land use codes and include any additional codes that may apply.

- Answer the questions regarding property exemptions or designations, ensuring to provide details where applicable.

- Calculate the gross selling price along with any personal property deductions and tax exemptions. Complete the state excise tax calculation based on the thresholds provided.

- Both the grantor and grantee must sign the document certifying that all provided information is true and accurate.

- Once completed, save your changes. You can download, print, or share the finished form for submission.

Complete your WA 84 0001a online for a seamless real estate transaction.

income. Every person whose estimated tax liability for the year is ₹10,000 or more, is liable to pay advance tax. However, a senior citizen need not to pay any advance tax, provided he does not have any income under the head "Profits and Gains of Business or Profession".

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.