Loading

Get Ny Oa Tax Partners Business Questionnaire 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY OA Tax Partners Business Questionnaire online

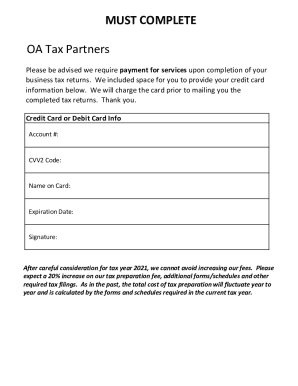

Filling out the NY OA Tax Partners Business Questionnaire is an essential step for businesses to ensure accurate tax reporting. This guide provides a clear understanding of how to complete the form online, helping users prepare their tax information effectively.

Follow the steps to successfully complete your business questionnaire.

- Click ‘Get Form’ button to obtain the questionnaire and open it in your preferred online form editor.

- Begin by entering your business name and the year ended. This information helps identify your entity and its reporting period.

- Provide the federal identification number, type of entity (e.g., C Corp, S Corp, LLC), and the state number if applicable. Each business structure has different tax obligations, so ensure accuracy.

- Fill in the street address, city, state, and zip code where your business operates. This information is vital for correspondence purposes.

- Indicate the business activity, specifying the products or services offered by your entity.

- Select the method of accounting used (cash or accrual) and detail the inventory method if relevant. This will impact how income and expenses are reported.

- Enter pertinent dates, including date incorporated, the start date of your business, and any S Corp election dates.

- List the shareholders, partners, or members of your entity, including their date of birth, social security number, address, percentage of ownership, and whether they are general or limited partners.

- Detail the income and expenses for your business, including gross receipts, rental income, and any costs incurred. Ensure that you accurately report all figures.

- Complete the section on depreciation and amortization, identifying any property used in the business and its associated costs.

- Finally, review the questionnaire for completeness and accuracy. Once satisfied, save your changes, download or print the completed form, and share it with your tax preparer.

Submit your completed documents online today to ensure timely filing and compliance with tax regulations.

The purpose of the first draft is to get one's ideas on paper and to try out a plan of organization for those ideas. Of course, it should follow the outline that you have prepared beforehand! Much of the effort of a first draft is experimental.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.