Loading

Get Account Application/credit Agreement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Account Application/Credit Agreement online

Completing the Account Application/Credit Agreement online can streamline your application process with Quality Gold, Inc. This guide provides clear, step-by-step instructions to ensure accurate and efficient submission.

Follow the steps to successfully fill out the form online.

- Click ‘Get Form’ button to obtain the form and open it in your browser.

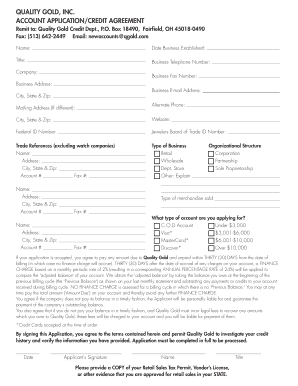

- Begin filling in your name in the designated field at the top of the form. Ensure that it matches your official identification.

- Provide the date your business was established. This information is important for verifying the longevity of your business.

- Enter your title within the company. This helps identify your role and authority in making financial decisions.

- Input your business telephone number in the appropriate section. Include the area code for accurate communication.

- Fill out the company name and, if applicable, your business fax number to ensure all contact methods are available.

- Provide your business address, including the city, state, and zip code. If you have a different mailing address, complete the corresponding fields.

- Include your business email address and website, if available, to facilitate contact and verification.

- Enter your Federal ID number and Jewelers Board of Trade ID number in the designated fields for proper identification.

- List your trade references, providing the name, address, account number, and fax number for each reference. Ensure they are not related to watch companies.

- Select the type of business that applies to you from the options provided: retail, wholesale, department store, or other. If ‘other’ is selected, provide an explanation.

- Indicate your organizational structure by selecting one of the options: corporation, partnership, or sole proprietorship.

- Specify the type of merchandise sold by your business to give context to your application.

- Choose the type of account you are applying for, such as C.O.D Account, Visa, MasterCard, or Discover, along with the corresponding amount.

- Read the credit agreement terms carefully. By signing, you agree to the payment timelines and responsibilities outlined in this document.

- Sign the application to authenticate the information provided. This step is crucial for the application process.

- Upload a copy of your Retail Sales Tax Permit or other required evidence that verifies your eligibility for retail sales.

- Finally, review all entered information for accuracy before saving your changes. You can then download, print, or share the completed form.

Start completing your Account Application/Credit Agreement online today for a seamless process.

When you've been accepted for a loan or a credit card - or even a store card - you're likely to receive an agreement from the lender. The agreement covers the details of the deal, including your rights as a borrower. Both you and the lender will have to sign this deal in order to go ahead with the contract.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.