Loading

Get 103-long 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 103-Long online

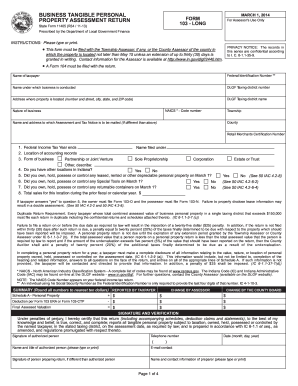

Filling out the 103-Long form is an essential part of reporting tangible personal property in Indiana. This guide provides clear steps to navigate the online process, ensuring that you complete your assessment return accurately and on time.

Follow the steps to complete your 103-Long form successfully.

- Press the ‘Get Form’ button to access the form and open it in your browser.

- Begin by filling in the taxpayer's name and federal identification number, as required at the top of the form.

- Indicate the name under which your business is conducted and provide the DLGF taxing district number.

- Fill in your NAICS code, which can be found on your federal tax return, along with the nature of your business.

- Report the total sales for your location during the prior fiscal or calendar year in the appropriate field.

- Once all fields are filled out accurately, review your form for completeness and accuracy.

Complete your 103-Long form online today to ensure timely and accurate assessment reporting.

Every business, church, and nonprofit organization must file an Indiana business tangible personal property tax return each year, even if they qualify for an exemption (see the section below).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.