Loading

Get Independent Contractor Waiver Of Workers Compensation Coverage

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Independent Contractor Waiver Of Workers Compensation Coverage online

This guide will help you navigate the process of completing the Independent Contractor Waiver Of Workers Compensation Coverage form online. By following these instructions, you can ensure that the form is filled out accurately and efficiently.

Follow the steps to complete your waiver form online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editing tool.

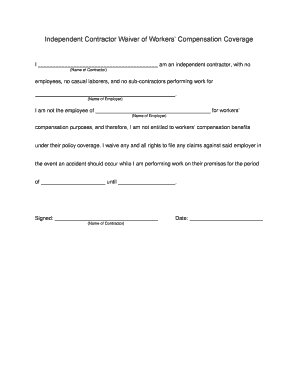

- Begin by entering your name in the designated area where it states 'Name of Contractor'. This should be your full legal name as the independent contractor.

- Next, indicate the name of the employer you are contracting with by filling in the 'Name of Employer' field. Make sure this is the correct legal name of the entity you are working under.

- Affirm that you do not have any employees, casual laborers, or sub-contractors performing work for you by checking or verifying the relevant statement in the form.

- Clearly state that you are not an employee of the employer by confirming that you understand your status for workers' compensation purposes. Ensure it is clear that you are waiving entitlement to benefits under their policy coverage.

- Specify the period of waiver by filling in the start and end date of the work period during which this waiver applies in the respective fields.

- Finalize by signing the form in the designated 'Signed' field, and including the date next to your signature. Make sure both are completed accurately.

- Once you have filled out all sections of the form, review your information for accuracy before proceeding to save, download, print, or share your completed form.

Complete your Independent Contractor Waiver Of Workers Compensation Coverage online today!

Workers' compensation benefits typically include some or all of the following: Lost wages. Medical expenses. Disability benefits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.