Loading

Get Application To Refund The Withholding Tax On Payments By Pension Funds Domiciled In Switzerland 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application To Refund The Withholding Tax On Payments By Pension Funds Domiciled In Switzerland online

Filling out the Application To Refund The Withholding Tax On Payments By Pension Funds Domiciled In Switzerland online can be a straightforward process when approached step by step. This guide aims to provide clear and supportive instructions tailored to users of all experience levels.

Follow the steps to successfully complete your application online.

- Click ‘Get Form’ button to obtain the form and open it in the designated editor.

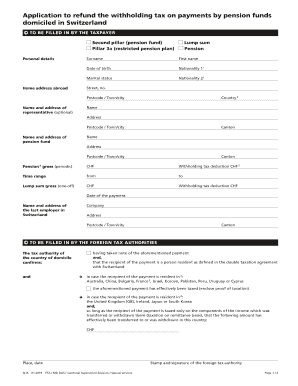

- In the 'Second pillar (pension fund)' and 'Pillar 3a (restricted pension plan)' sections, provide your personal details: enter your surname, first name, date of birth, nationality, and marital status.

- Fill in your home address abroad, including street, postcode, town/city, and country.

- If applicable, include the name and address of a representative. Enter their name, address, postcode, and canton.

- Provide the name and address of your pension fund, including the name, address, postcode, and canton.

- In the 'Pension gross (periodic)' section, input the gross pension amount in CHF and the withholding tax deduction in CHF, alongside the time range specifying 'from' and 'to' dates.

- For any lump-sum payments, enter the lump sum gross amount in CHF and the corresponding withholding tax deduction.

- Fill in the date of payment and the name and address of your last employer in Switzerland.

- In the 'Payment details for the refund of withholding tax' section, include your bank details: name of the bank, subsidiary, bank address, account number (IBAN), BIC/SWIFT, and account holder's name.

- Complete the form with the place, date, and your signature. Ensure both pages of the form are completed in full.

- Submit both pages of the completed form to the cantonal tax administration where your pension fund is located.

- Remember to attach any necessary enclosures: such as a copy of the payment slip for lump sums or a pension statement for pension benefits.

Begin submitting your application online today to ensure a smooth refund process.

Related links form

Under certain conditions, the anticipatory tax levied in Switzerland on certain income can be reclaimed – even if you have your tax residence abroad. In this article, we explain everything you need to know about anticipatory tax and how to reclaim it.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.