Loading

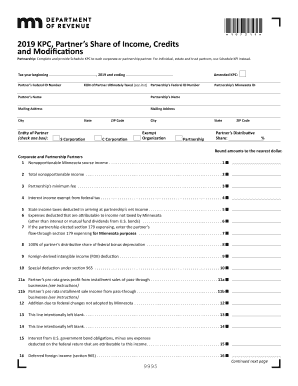

Get Kpc Partners Share Of Income Credits And Modifications 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KPC Partners Share Of Income Credits And Modifications online

The KPC Partners Share Of Income Credits And Modifications is a critical document for reporting the partnership's income, credits, and modifications for tax purposes. This guide provides a step-by-step approach to ensure accurate and efficient completion of the form online, whether you possess prior experience or are new to digital document management.

Follow the steps to successfully complete the KPC Partners Share Of Income Credits And Modifications online.

- Click the ‘Get Form’ button to retrieve the form and access it in the editor.

- Enter the tax year period by specifying the beginning and ending dates for the year 2019.

- Provide the partner’s federal identification number and indicate if the KPC is amended.

- Input the FEIN of the partner ultimately taxed and the partnership’s federal ID number.

- Fill in the names of the partner and the partnership, including the mailing addresses and city/state/ZIP code.

- Select the box corresponding to the entity type of the partner: S Corporation, C Corporation, Exempt Organization, or Partnership.

- Indicate the partner's distributive share percentage and ensure amounts are rounded to the nearest dollar.

- Complete the details for the nonapportionable Minnesota source income and total nonapportionable income on the specified lines.

- Record any applicable amounts related to the partnership's minimum fee and exempt interest income, following the structured guidelines.

- Proceed to fill out fields related to deductions, such as state income taxes and expenses attributable to exempt income.

- Review lines for federal bonus depreciation, section 179 expensing, and any other relevant credits.

- After completion of all required fields, review the entered information for accuracy.

- Finally, users can save the changes, download a copy, print the document, or share it as necessary.

Start filling out your forms online to ensure seamless tax reporting and compliance.

Items that must be separately stated include, but are not limited to: net income or loss from rental activities, including rental real estate activities; portfolio income or loss and related expenses; Code Sec.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.