Loading

Get It-6-sny 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IT-6-SNY online

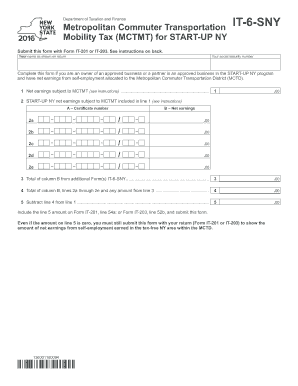

The IT-6-SNY form is essential for owners and partners of approved businesses in the START-UP NY program to report their net earnings from self-employment allocated to the Metropolitan Commuter Transportation District. This guide will walk you through each section of the online form, ensuring clarity and comprehension for all users.

Follow the steps to complete the IT-6-SNY form online.

- To begin, locate and click the 'Get Form' button to retrieve the IT-6-SNY form and open it in your preferred online editor.

- Enter your name as it appears on your tax return in the designated field.

- Input your social security number in the corresponding section, ensuring accuracy.

- On line 1, provide the total net earnings from self-employment allocated to the Metropolitan Commuter Transportation District from all sources, including businesses under the START-UP NY program.

- For line 2, enter the 14-digit certificate number from your START-UP NY certificate of eligibility, and list your net earnings from self-employment for each approved business within the tax-free NY area located in the MCTD.

- If you have multiple approved businesses, you may need to submit additional Form(s) IT-6-SNY, filling out only your name, social security number, and line 2 on those forms.

- Calculate and enter the total from column B of any additional Form(s) IT-6-SNY on line 3.

- On line 4, add the amounts from lines 2a through 2e and any amount from line 3.

- On line 5, subtract the total on line 4 from the amount on line 1.

- Finally, include the amount from line 5 on Form IT-201, line 54a, or Form IT-203, line 52b, and submit this completed form alongside your tax return.

Complete your IT-6-SNY form online today to ensure your tax obligations are met.

This MCTMT is assessed based on the employer's total payroll expense that an employer has or a certain amount of net income that a self-employed individual generates. The maximum MCTMT rate is 0.34%. The tax rate scale is based on how much payroll the employer pays for covered employees each calendar quarter.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.