Loading

Get Ma-va Form 40/41 And Ma-va Form 40ss/41 2007-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA-VA Form 40/41 and MA-VA Form 40ss/41 online

This guide provides a clear and supportive approach to completing the MA-VA Form 40/41 and MA-VA Form 40ss/41 online. By following the step-by-step instructions, you can confidently fill out and submit your application for exemption from real property taxes.

Follow the steps to successfully fill out your application online.

- Press the ‘Get Form’ button to access the form and launch it in the editor. Make sure you have a stable internet connection for smooth access.

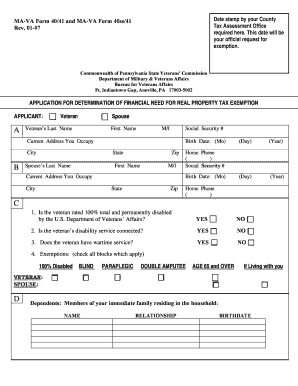

- Begin with the general information section. If you are a veteran, check the box labeled 'veteran’. If you are the surviving spouse of a qualified veteran who has not remarried, select the 'spouse' box.

- Complete Section A by filling in all required fields for the veteran, including their last name, first name, middle initial, and Social Security number.

- Proceed to Section B to fill out the same personal information for the spouse, including their last name and first name, as applicable.

- In Section C, indicate the veteran’s disability rating and exemptions by checking all applicable blocks, such as '100% Disabled' or 'Blind'.

- For Section D, list dependent members of the household. Include the name of each dependent along with the relationship to the veteran and their respective dates of birth.

- Fill out Section E with property information, confirming ownership status by selecting the appropriate options regarding whether the property is solely in your name, jointly titled, or includes other properties.

- In Section F, record all annual income amounts for both the veteran and the spouse, including various income sources such as V.A. compensation, pensions, or rental income. Ensure that you submit supporting documentation for verification.

- If applicable, complete Section G monthly expenses. This section is mandatory if your annual income exceeds $75,000. You will need to categorize expenses and attach the required documentation for verification.

- In Section H, read the notice before signing to certify that all information provided is accurate. This signature must be witnessed and sworn in front of a notary public or a jurat stamp holder.

- Ensure that your application is date stamped by your County Tax Assessor’s Office, as this will be your formal request for exemption.

- Once you have completed all sections accurately, save your changes. You may download, print, or share your completed form as necessary.

Complete your MA-VA Form 40/41 and MA-VA Form 40ss/41 application online today to secure your real property tax exemption.

Benefit Fact Sheet Military retirement pay based on age or length of service is considered taxable income for Federal income taxes. However, military disability retirement pay and Veterans' benefits, including service-connected disability pension payments, may be partially or fully excluded from taxable income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.