Loading

Get Form 720vi 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 720VI online

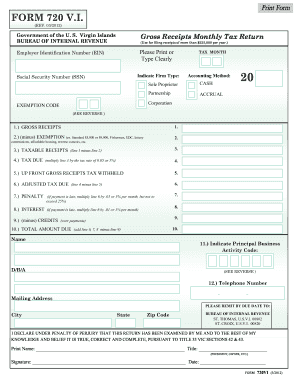

Filling out the Form 720VI online is a crucial step for businesses in the U.S. Virgin Islands that exceed a gross receipt of $225,000 annually. This guide will walk you through each section of the form, ensuring that you provide all necessary information accurately and efficiently.

Follow the steps to complete the Form 720VI online:

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your Employer Identification Number (EIN) clearly as instructed at the top of the form.

- Select the tax month for which you are filing the return.

- Indicate your firm's type by checking the appropriate box: Sole Proprietor, Partnership, or Corporation.

- Select your accounting method, either cash or accrual.

- Report your gross receipts for the month in line 1.

- Deduct any applicable exemptions in line 2, referring to the provided exemption codes if necessary.

- Calculate your taxable receipts in line 3 by subtracting line 2 from line 1.

- Determine the tax due in line 4 by multiplying line 3 by the tax rate of 0.05 (5%).

- If applicable, enter the upfront gross receipts tax withheld in line 5.

- Calculate your adjusted tax due in line 6 by subtracting line 5 from line 4.

- If payment is late, calculate the penalty in line 7 by multiplying line 6 by 0.05 (5%) for each month late, up to a maximum of 25%.

- Calculate any interest owed in line 8 at a rate of 0.01 (1%) per month for late payments.

- Enter any applicable credits in line 9 for overpayments.

- Calculate the total amount due in line 10 by adding lines 6, 7, and 8, then subtracting line 9.

- Provide your name, title, telephone number, and mailing address in the designated sections.

- Sign and date the form to affirm that the information provided is true and complete.

- Once you have completed the form, use the available options to save changes, download, print, or share the completed form.

Complete your Form 720VI online today and ensure accurate and timely submission.

You can electronically file Form 720 through any electronic return originator (ERO), transmitter, and/or intermediate service provider (ISP) participating in the IRS e-file program for excise taxes. For more information on e-file, go to Excise Tax e-File & Compliance (ETEC) Programs - Forms 720, 2290, and 8849.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.