Loading

Get Lp-1 2008-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LP-1 online

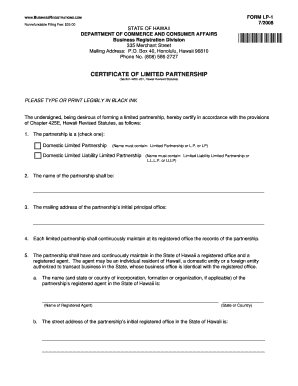

This guide provides you with clear and supportive instructions for completing the LP-1 form online. By following these steps, you can effectively navigate the process of establishing a limited partnership in Hawaii.

Follow the steps to successfully complete the LP-1 form.

- Press the ‘Get Form’ button to access the LP-1 form and open it in your editor.

- Begin by indicating the type of partnership you wish to form. Choose either ‘Domestic Limited Partnership’ or ‘Domestic Limited Liability Limited Partnership’ by checking the appropriate box.

- Next, enter the name of the partnership in the designated field. Ensure that the name includes either ‘Limited Partnership’, ‘L.P.’, or ‘LP’ for a Domestic Limited Partnership, or ‘Limited Liability Limited Partnership’, ‘L.L.L.P.’, or ‘LLLP’ for a Limited Liability Limited Partnership.

- Provide the mailing address for the initial principal office of the partnership in the specified space.

- Designate a registered agent for the partnership. Fill in the name and state or country of incorporation where applicable in the provided fields.

- Input the street address of the partnership’s initial registered office in Hawaii. This address must match that of the registered agent.

- List the names and addresses of each general partner. Fill in all necessary spaces for the details of each partner.

- Finally, certify the form by having at least one general partner sign and date it. Ensure that the name is printed clearly next to the signature.

- Once you have completed the form, you may save the changes, download a copy, print the document, or share it as necessary.

Complete your LP-1 form online today to establish your limited partnership efficiently.

Limited Partnership The amount of their liability is limited to their investment in the LP. Note: To limit the liability for general partners, many LPs use an LLC or corporation as the general partner because of their limited liability. Control over business decisions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.