Loading

Get Or 150-101-178 2009-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR 150-101-178 online

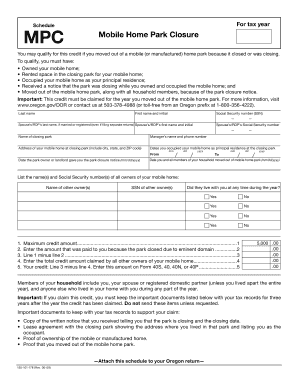

The OR 150-101-178 form is essential for claiming a tax credit for individuals who have moved out of a mobile home park due to its closure. This guide provides clear, step-by-step instructions to help you fill out the form accurately, ensuring you understand each component required for submission.

Follow the steps to accurately fill out the OR 150-101-178 form.

- Press the 'Get Form' button to access the form and open it for editing.

- Begin by entering your last name, first name, and initial in the designated fields.

- Provide your Social Security number (SSN). If married or registered, include your spouse's or registered domestic partner's last name, first name, initial, and SSN.

- Indicate the name of the closing mobile home park and the manager's name and phone number.

- Fill in the address of your mobile home at the closing park, including city, state, and ZIP code.

- Enter the dates you occupied your mobile home at the park, specifying the 'From' and 'To' dates.

- Document the date you received the park closure notice.

- Record the date you and all household members moved out of the mobile home park.

- List the names and Social Security numbers of all other owners of the mobile home and indicate if they lived with you at any point during the year.

- Complete the credit calculations by entering the maximum credit amount, any amount paid due to eminent domain, and the total credit claimed by other owners.

- Calculate your credit by following the provided lines and enter the final amount on the appropriate tax form (Form 40S, 40, 40N, or 40P).

- Ensure you keep important documents related to your claim with your tax records for three years, but do not send them unless requested.

Start completing your OR 150-101-178 form online today to claim your credit.

In 2023, you'll be able to claim a tax credit up to $600 for electrical panel upgrades. This tax credit does not count against the tax credit up to $2,000 for a new energy efficient heat pump or the solar tax credit that covers up to 30% of the cost for rooftop solar and battery storage.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.