Loading

Get Canada 5006-r 2016-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada 5006-R online

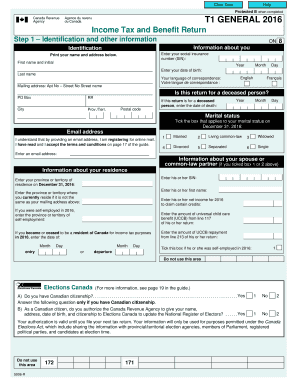

The Canada 5006-R form is an important document for individuals reporting their income to the Canada Revenue Agency. This guide provides clear and comprehensive instructions on how to easily complete the form online, ensuring all required information is accurately submitted.

Follow the steps to successfully complete the Canada 5006-R form online.

- Press the ‘Get Form’ button to access the Canada 5006-R form and open it in your preferred editor.

- Begin by entering your social insurance number (SIN) in the designated field.

- Print your first name, middle initial, and last name, followed by your mailing address details, including your apartment number, street number, street name, city, province/territory, and postal code.

- Provide your date of birth in the specified format (year, month, day).

- If this return is for a deceased individual, indicate the date of death in the provided fields.

- Select your marital status as of December 31 of the applicable tax year by ticking the appropriate box.

- If applicable, enter the social insurance number and details of your spouse or common-law partner.

- Fill in your province or territory of residence as of December 31.

- Complete the foreign property ownership question, indicating whether you owned specified foreign property exceeding CAN$100,000 at any time in the year.

- Proceed to report your total income, making sure to include all income sources both from within Canada and abroad, following the line numbers as instructed.

- Calculate your net income by providing various deductions as outlined in the form.

- After completing the details, you can save changes, download, print, or share the form as needed.

Start filling out your Canada 5006-R form online today for a seamless tax reporting experience.

How you file affects when you get your refund. The Canada Revenue Agency's goal is to send your refund within: 2 weeks, when you file online. 8 weeks, when you file a paper return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.