Loading

Get Irs Worksheet For Determining Support_dsa

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Worksheet For Determining Support_DSA online

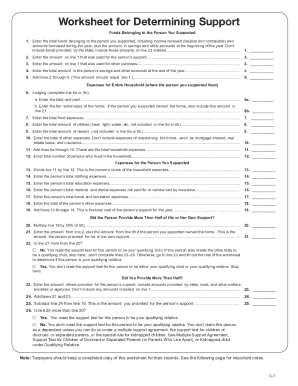

Filling out the IRS Worksheet For Determining Support_DSA is essential for determining if a person qualifies as a dependent under tax regulations. This guide provides clear instructions for completing the worksheet effectively and accurately.

Follow the steps to fill out the worksheet efficiently.

- Press the ‘Get Form’ button to access the IRS Worksheet For Determining Support_DSA and open it in your preferred editor.

- In the first section, titled 'Funds Belonging to the Person You Supported', enter the total funds for the supported person in line 1. This includes all income, savings, and borrowed amounts appropriated during the year, excluding state-provided funds.

- For line 2, input the amount from line 1 specifically utilized for that individual's support. Line 3 should contain the portion of line 1 spent on other purposes.

- Document the total funds in the individual's savings and accounts at the end of the year in line 4.

- In line 5, calculate the total of lines 2 through 4. This figure should match the amount entered in line 1.

- Proceed to 'Expenses for Entire Household' starting with line 6, where you will complete either 6a (total rent paid) or 6b (fair rental value of owned home).

- Enter the total food expenses for the household in line 7, followed by the total utility costs in line 8.

- In line 9, write down the total expenditure on repairs not covered in lines 6a or 6b. Then, in line 10, include other household expenses (excluding those for maintaining the home).

- Add up all the household expenses from lines 6a through 10 and place the total in line 11. Specify the total number of individuals living in the household in line 12.

- To find the person’s share of household expenses, divide the total from line 11 by the number of individuals noted in line 12 and record this in line 13.

- Fill in lines 14 to 18 by listing the respective clothing, education, medical, travel, and other expenses incurred by the supported person.

- Sum the totals from lines 13 through 18, placing the final figure in line 19, marking the total cost of support for the year.

- In line 20, calculate 50% of the amount in line 19. Then, for line 21, sum the amounts in line 2 and, if applicable, line 6b to determine what the person contributed to their own support.

- Check if line 21 exceeds line 20. If it does not, you meet the support test. If it does, proceed to line 23 for further evaluation.

- In line 23, account for any external support provided to the person and compile this information.

- Sum the figures from line 21 and line 23 in line 24. Subtract this from line 19 to determine the amount you provided for their support, recording that in line 25.

- Lastly, check if the amount noted in line 25 surpasses line 20 to confirm if you meet the support test for claiming the person as a dependent.

Start filling out your IRS Worksheet For Determining Support_DSA online today to ensure accurate support assessments.

You figure whether you have provided more than half of a person's total support by comparing the amount you contributed to that person's support with the entire amount of support that person received from all sources. This includes support the person provided from his or her own funds.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.