Loading

Get Irs Worksheet Solutions: The Difference Between Tax Avoidance And Tax Evasion_dsa

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the IRS Worksheet Solutions: The Difference Between Tax Avoidance And Tax Evasion_DSA online

This guide provides a comprehensive overview of how to effectively fill out the IRS Worksheet Solutions: The Difference Between Tax Avoidance And Tax Evasion_DSA online. By following these instructions, users can navigate the form with ease and ensure accurate submissions.

Follow the steps to navigate the IRS worksheet effectively.

- Press the ‘Get Form’ button to access the worksheet and open it in your preferred online platform.

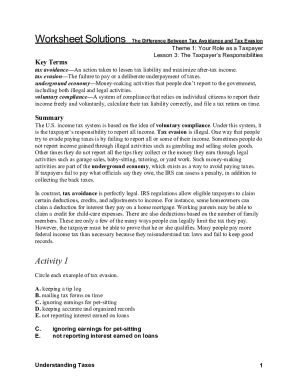

- Begin by reading through the introductory section of the form, which outlines key terms like 'tax avoidance' and 'tax evasion.' Familiarizing yourself with these concepts will help you understand the purpose of the worksheet.

- Move to the section that outlines your role as a taxpayer. It is essential to understand your responsibilities, including the need for voluntary compliance by accurately reporting your income.

- In the activity sections, circle each example of tax evasion as prompted, ensuring to differentiate it from lawful practices.

- Complete the reflection questions under each activity using clear explanations to distinguish between tax avoidance and tax evasion, based on the scenarios provided.

- Review your responses for accuracy and completeness. Make sure each section of the form is filled out according to the instructions.

- Once you have reviewed the form, you can save your changes, download it, print it for your records, or share it as necessary.

Start filling out the IRS Worksheet online now to ensure your compliance with tax regulations.

Putting money in a 401(k) or taking advantage of a tax-deductible donation are perfectly legal methods of lowering a tax bill (tax avoidance), as long as you follow the rules. Concealing assets, income or information to dodge liability typically constitutes tax evasion.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.