Get Us Bank Declaration Of Lost Stolen Or Destroyed Tellers Or Cashiers Check

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the US Bank Declaration Of Lost Stolen Or Destroyed Tellers Or Cashiers Check online

Filling out the US Bank Declaration of Lost, Stolen or Destroyed Teller's or Cashier's Check is a crucial step in securing your financial interests. This guide will walk you through each section of the form to ensure a smooth and efficient process.

Follow the steps to complete the form accurately and efficiently.

- Press the ‘Get Form’ button to access the Declaration of Lost, Stolen or Destroyed Teller's or Cashier's Check and open it for editing.

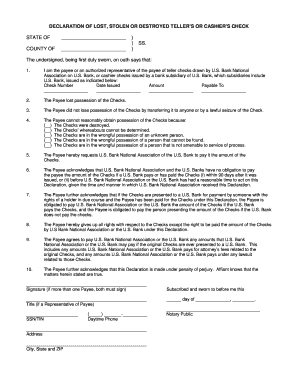

- In the first section of the form, provide the check number, the date it was issued, the amount, and who the check is payable to. Make sure all information is accurate.

- Next, confirm that you are the payee or an authorized representative of the payee by including your name and designation.

- In the following section, specify that you lost possession of the checks. Check the appropriate boxes to indicate the reasons for your inability to obtain the checks.

- Instruct the bank to pay the amount of the checks requested by filling in the specified section. Ensure that this aligns with the previous entries regarding the lost checks.

- Acknowledge the conditions set forth by the bank in terms of obligations regarding the checks. Read this section carefully and ensure you understand the implications.

- Sign and date the form at the bottom. If there is more than one payee, ensure both signatures are provided in the designated area.

- Lastly, include your taxpayer identification number or social security number, along with your daytime phone number and address for contact purposes.

- Once all fields are filled out correctly, save your changes, then download, print, or share the completed form as needed.

Complete your documents online with confidence.

If you lose a cashier's check you must notify the bank, fill out a declaration of lost form, and wait–it can take 90 days (after you file) to recoup the money. The bank will levy a fee of $30 or more when you cancel a cashier's check.

Fill US Bank Declaration Of Lost Stolen Or Destroyed Tellers Or Cashiers Check

A claimant who delivers a declaration of loss makes a warranty of the truth of the statements made in the declaration. A person who claims the right to receive the amount of a cashier's check, teller's check or certified check that was lost, destroyed or stolen. "Immediately contact the bank if a cashier's check is lost, stolen, destroyed or suspected of fraud. You must also take precaution in safeguarding your blank checks. Notify us at once if you believe your checks have been lost or stolen. Most banks should have an affidavit that the check has been lost and get one reissued. (2) "Claimant" means a person who claims the right to receive the amount of a check that was lost, destroyed, or stolen. Lost, Stolen or Destroyed Cashier's Checks. In the case of a lost, damaged or stolen cashier's check, you can ask your bank to reissue the check. If the cashier's check is lost, stolen, or destroyed, you may request a stop payment and reissuance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.