Loading

Get Tn Rv-f1321001 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TN RV-F1321001 online

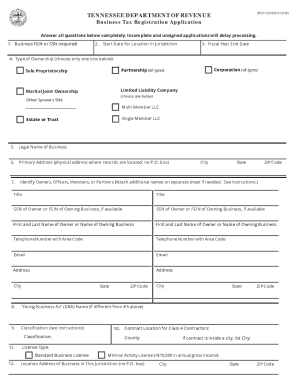

Filling out the TN RV-F1321001 form online is an essential step for businesses in Tennessee to register for business tax. This guide provides a comprehensive overview and step-by-step instructions to help users complete the form accurately.

Follow the steps to fill out the TN RV-F1321001 form online.

- Click the ‘Get Form’ button to access the TN RV-F1321001 and open it in your browser for editing.

- Enter your business federal employer identification number (FEIN) or the owner's social security number (SSN) in the required field.

- Provide the start date for your business location within the jurisdiction, specifying the month, day, and year.

- Indicate your business' fiscal year end date, which should align with your federal tax year.

- Select the type of ownership by checking only one of the boxes available — options include sole proprietorship, partnership, marital joint ownership, limited liability company, corporation, estate or trust.

- Fill in the legal name of your business, which should match the name registered with the Tennessee Secretary of State.

- Input the primary address where your business records are located, ensuring it is a physical address (no P.O. box).

- List the owners, officers, members, or partners associated with your business. Include their titles, social security numbers (if available), and contact information.

- If applicable, enter your 'doing business as' (DBA) name in the designated field.

- Select the appropriate classification for your business by referring to the Business Tax Guide, if needed.

- If you are a Class 4 contractor, specify the contract location city and county. Only indicate the city if the work occurs within a city that issues business licenses.

- Choose the license type: standard business license or minimal activity license (for businesses under $10,000 in annual revenue).

- Detail the principal business activity at this location, outlining the main products and/or services offered.

- Provide your business mailing address, which may include a P.O. box.

- Enter your business telephone number, fax number (if applicable), and email address.

- List the contact name, telephone number, and email address for future communications regarding tax filings.

- Ensure the form is signed and dated by at least one owner, officer, member, or partner of your business.

- After completing the application, you can save changes, download the form, print it, or share it as needed for submission.

Complete your TN RV-F1321001 application online today to ensure your business is properly registered for tax purposes.

To obtain a certificate of tax clearance, a business must file all returns to date and make all required payments. This includes filing a final franchise & excise tax return through the date of liquidation or the date the taxpayer ceased operations in Tennessee.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.