Loading

Get Irs 1040 - Schedule E 2003-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 - Schedule E online

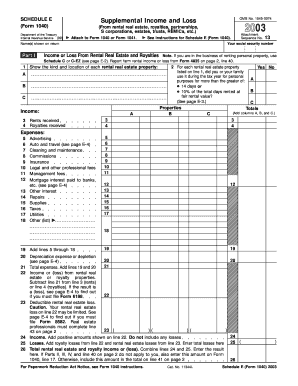

The IRS 1040 - Schedule E is an essential form for reporting supplemental income and loss from various sources such as rental real estate, royalties, and partnerships. This guide provides a detailed, step-by-step approach to help users navigate and complete the form accurately online.

Follow the steps to fill out your IRS 1040 - Schedule E correctly.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin by entering your name(s) and Social Security number at the top of the form. Ensure that this information matches what is on your tax return.

- In Part I, provide information about each rental real estate property. Indicate the kind and location of the properties and answer whether you or your family used it for personal purposes.

- Report the income received from rentals and royalties in lines 3 and 4 respectively.

- In the expenses section (lines 5-18), fill in applicable expenses such as advertising, insurance, and repairs. Ensure to provide accurate figures for each category.

- Add up the total expenses and enter the sum on line 21. Calculate your income or loss from the properties by subtracting the total expenses from the total income (line 22).

- If applicable, address any deductible rental real estate losses on line 23 and verify the requirements for Form 8582.

- Complete Parts II, III, and IV if you have income or losses from partnerships, S corporations, estates, trusts, or REMICs. Be sure to check the relevant boxes and provide correct amounts.

- Summarize the total income or loss from all sources in Part V and enter the final result on line 41 of Schedule E.

- Once you have filled out all sections of the form, save your changes, and you'll have the option to download, print, or share the completed form.

Start filling out your IRS 1040 - Schedule E online today for a smooth filing experience.

If you rented out one of these homes or space in your primary home, you can still report the mortgage interest on a Schedule A so long as you rented the space for fewer than 15 days. If you rented a property for more than 15 days, you must report your rental income and file a Schedule E.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.