Loading

Get Au Sir1-pss 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AU SIR1-PSS online

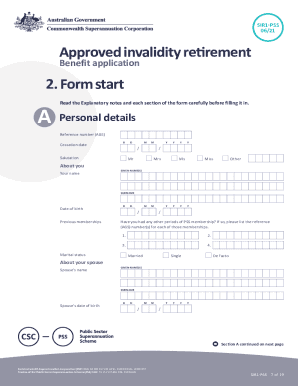

The AU SIR1-PSS form is essential for Public Sector Superannuation Scheme members applying for approved invalidity retirement benefits. This guide provides a clear, step-by-step approach to filling out this important document online, ensuring you provide all necessary information accurately.

Follow the steps to complete your AU SIR1-PSS form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Section A, where you will fill in your personal details, including your reference number, name, date of birth, and contact information. Ensure all boxes are completed for proper identification.

- Move to Section B to fulfill the identification requirements. You can authorize electronic verification of your documents or provide certified copies as needed.

- In Section C, provide details about your former employment, including the name of your last employing department.

- Proceed to Section D to complete the information acknowledgment, confirming you understand your benefit options.

- Select your preferred benefit option in Section E. You can choose from options including pension only, part pension and part lump sum, or a lump sum only. Ensure only one option is marked.

- Complete Section F by declaring any personal earnings you expect to receive after retirement, if applicable.

- In Section G, specify your benefit payment arrangements. Indicate how much of your lump sum you want to receive as cash and provide details for any rollovers.

- Fill out Section H by providing your taxation information such as your start date and tax file number.

- Finally, review the member checklist at the end of the form to ensure all required sections have been completed and all necessary documentation is attached.

- After verifying all information, submit the completed form to your personnel section or pay office for processing.

Complete your AU SIR1-PSS form online today to ensure a smooth application process!

There are a number of ways you can withdraw your super in retirement, and how you access your money will depend on your specific circumstances. Depending on these circumstances, you'll be able to claim your benefit as a lifetime fortnightly indexed pension , a lump sum or a combination of both.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.