Loading

Get Canada Gst426-5 E 2002-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada GST426-5 E online

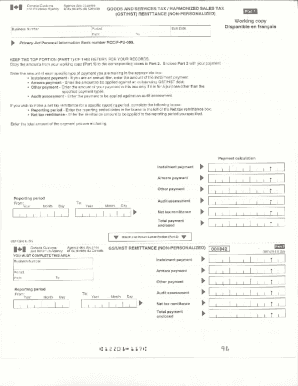

Filling out the Canada GST426-5 E form online can streamline your tax processing and ensure accuracy. This guide provides a step-by-step approach to help you complete the form with ease.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Review the form's introduction section, which outlines the purpose and necessary information required to complete the GST426-5 E form.

- Fill in your personal information in the designated fields. Ensure that you provide accurate details such as your name, address, and contact information.

- Complete the section detailing your tax information. This includes the reporting periods, tax amounts, and any applicable deductions as specified by the form.

- Check the boxes that apply to your situation based on the instructions provided in the form. It is essential to review this section carefully.

- Review all entered information for accuracy and completeness. Make sure there are no errors or missing fields before proceeding.

- Once you have completed the form, use the options provided to save your changes. You can choose to download, print, or share the completed form as needed.

Get started with your document preparation online today.

You have to register for a GST/HST account if both situations apply: You make taxable sales, leases, or other supplies in Canada (unless your only taxable supplies are of real property sold other than in the course of a business) You are not a small supplier.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.