Loading

Get Dol Eta 9061 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DoL ETA 9061 online

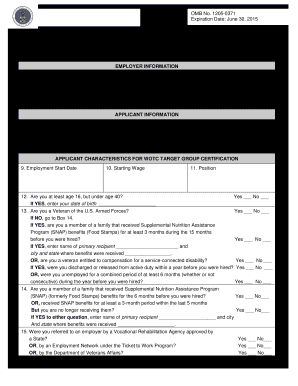

Filling out the DoL ETA 9061 correctly is crucial for determining eligibility for the Work Opportunity Tax Credit (WOTC) program. This guide will assist users in accurately completing the form online, ensuring that all required information is provided efficiently.

Follow the steps to complete the DoL ETA 9061 successfully.

- Use the ‘Get Form’ button to access the form and open it in the online editor.

- In the employer information section, enter the employer's name, address, telephone number, and Federal ID number (EIN) precisely as required.

- Provide the applicant's information, including their name and social security number as it appears on their social security card.

- Indicate whether the applicant has previously worked for the employer by selecting yes or no, and if applicable, provide the last date of employment.

- Complete each question regarding applicant characteristics for WOTC target group certification by selecting yes or no and providing any additional information as requested.

- In the sources used to document eligibility section, list all documentation that substantiates affirmative answers from the previous questions, marking whether they are attached or forthcoming.

- Ensure that the form is signed in the appropriate section by the designated person (applicant, employer, or representative), and include the date when the form was signed.

- Once all fields have been completed, review the information for accuracy, then save changes, download, print, or share the form as needed.

Take the next step and complete your documents online for streamlined processing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The Work Opportunity Tax Credit serves to incentivize employers to hire individuals from specific target groups who face barriers to employment. This program aims to encourage job creation and enhance workforce diversity. Understanding how the DoL ETA 9061 fits into this framework can empower businesses to take advantage of these tax benefits.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.