Loading

Get Au Nat 3093 2013-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AU NAT 3093 online

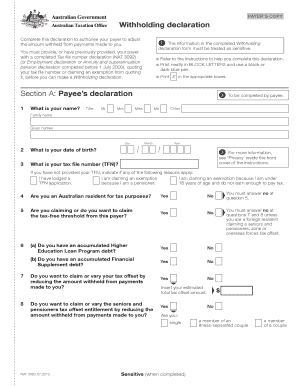

This guide provides comprehensive instructions for users to fill out the AU NAT 3093 form, also known as the withholding declaration. It aims to enhance understanding and simplify the process of completing this important document online.

Follow the steps to fill out the AU NAT 3093 online successfully.

- Click ‘Get Form’ button to access the AU NAT 3093 form and open it in your preferred online editor.

- Begin by filling in your name in Section A. Include your title, family name, and given names as requested.

- Enter your date of birth. Ensure the format matches the specified requirements of day, month, and year.

- Provide your tax file number (TFN). If you have not previously supplied your TFN, indicate the applicable reason from the listed options.

- Indicate your residency status for tax purposes by selecting 'Yes' or 'No.'

- Select whether you are claiming the tax-free threshold from this payer.

- Answer the questions regarding any accumulated debts under the Higher Education Loan Program and Financial Supplement.

- Provide details regarding your tax offsets if applicable. Insert your estimated total tax offset amount.

- If you wish to increase the amount withheld from payments made to you, select 'Yes' and complete the relevant details.

- Sign and date the declaration in Section A to confirm that the information provided is accurate.

- Once completed, you can save changes, download the form, print it, or share it as necessary.

Complete your AU NAT 3093 form online today for a streamlined process.

Varying your withholding rate. If you answer Yes at question 10 or 11, you will need to get a Withholding declaration (NAT 3093) from your payer. You also need to complete a Withholding declaration if at any time. you wish to: • advise a change to your tax offset or family tax benefit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.