Loading

Get Types Of Fraudulent Activities - General Fraud - Internal Revenue ...

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Types Of Fraudulent Activities - General Fraud - Internal Revenue ... online

Filling out the Types Of Fraudulent Activities - General Fraud - Internal Revenue ... online can seem daunting, but with this comprehensive guide, you will navigate through each section with confidence. This guide breaks down submission into simple, actionable steps, ensuring a clear understanding about what information is required.

Follow the steps to effectively complete your form online.

- Use the ‘Get Form’ button to initiate the form download and access it in your online document management platform for editing.

- Begin by providing your identifying information in the designated fields. Ensure that your name, address, and any relevant identification numbers are accurately entered.

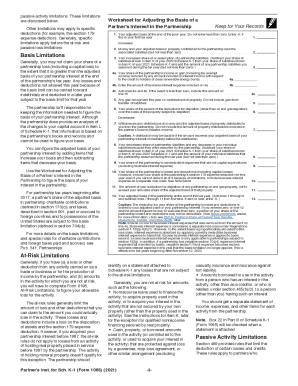

- Complete Part I regarding the information about the partnership. Ensure all required identifiers, such as partnership name and address, are filled in properly.

- Proceed to Part II to input your own details as the partner. Check for accuracy in your individual tax identification number.

- In Part III, indicate your share of items such as income, loss, deductions, and credits. Be thorough to ensure all relevant amounts are included.

- Review any other relevant sections to ensure completeness. Look out for any codes and comments that require your attention.

- Once all information is reviewed and accurate, utilize the options available in your online platform to save your work, or download, print, or share the completed form as necessary.

Start filling out your form online now to ensure a streamlined and effective submission process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Overview. IRS CI is comprised of approximately 3,000 employees worldwide, about 2,100 of whom are special agents whose investigative jurisdiction includes tax, money laundering and Bank Secrecy Act laws.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.