Loading

Get Canada T2222 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T2222 online

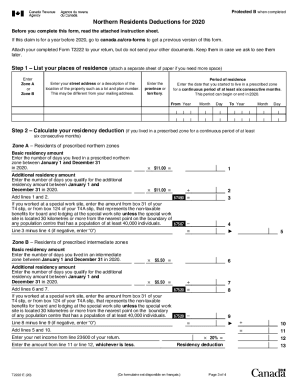

This guide provides a clear, step-by-step approach to completing Form T2222, Northern Residents Deductions for 2020, online. Understanding this form will help you navigate the process smoothly and ensure you accurately claim your deductions.

Follow the steps to complete Form T2222 with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Step 1, enter 'Zone A' if you lived in a prescribed northern zone, or 'Zone B' for a prescribed intermediate zone. Include your address, province or territory, and the dates you lived there.

- Proceed to Step 2 to calculate your residency deduction. If you lived in a prescribed zone for at least six consecutive months, calculate the basic residency amount by entering the number of days and multiplying it by $11.00 for Zone A or $5.50 for Zone B.

- For the additional residency amount in Step 2, if you maintained a dwelling and are the only individual claiming it, enter the number of days and multiply by the same respective amounts.

- If applicable, include any non-taxable benefits for board and lodging at a special work site in your calculation. Adjust your residency deduction accordingly in Step 2.

- In Step 3, calculate your deduction for travel benefits. List all individuals who lived with you and provide the taxable travel benefits received and expenses incurred for each trip taken.

- For each trip, enter the lowest amount across taxable travel benefits, travel expenses, or the cost of the lowest return airfare available. Add these amounts to get the deduction for travel benefits.

- Finally, in Step 4, sum your residency deduction and deduction for travel benefits. Enter the total on line 25500 of your return. Review your entries to ensure accuracy before saving or submitting.

Begin filling out the Canada T2222 online to ensure you receive the deductions you're eligible for.

If you lived in a prescribed northern zone, you can claim the basic amount of $11 for each day that you lived in this zone. If you lived in a prescribed intermediate zone, you can claim the basic amount of $5.50 for each day that you lived in this zone.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.