Loading

Get Fidelity Investments Instructions For Completing Irs Section 83(b) Form 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fidelity Investments Instructions For Completing IRS Section 83(b) Form online

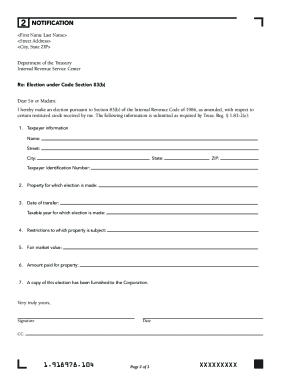

Filling out the IRS Section 83(b) form is an important step for users who have received restricted stock awards. This guide provides a comprehensive overview of how to complete the form online, ensuring that you meet your filing obligations within the required timeframe.

Follow the steps to complete your Section 83(b) election form accurately.

- Press the ‘Get Form’ button to access the form and open it in the editor.

- At the top of the form, write your name, address, and the date. Below 'Department of the Treasury,' address the form to the IRS Service Center where you file your taxes, as indicated in the mailing instructions.

- In Box 1, provide your name, address, and Social Security number in the corresponding fields.

- In Box 2, indicate the number of shares and describe the shares of stock you are electing under Section 83(b).

- In Box 3, write the calendar year during which you were granted the Restricted Stock Awards. This information is found on your Award Date.

- In Box 4, describe the restrictions that are applied to your awards. This information can be obtained from your Award agreement. If you need assistance, contact your Plan Administrator.

- In Box 5, record the closing price of your company’s stock on the Award Date.

- In Box 6, state the amount you paid for your Awards. If you did not pay anything, clarify that no amount was paid for the shares.

- Ignore Box 7 as no information needs to be written here.

- After completing the form, sign it. Mail a copy of the form to your IRS Service Center and to your employer. Ensure to keep a copy for your tax records.

Complete your IRS Section 83(b) election form online today to ensure timely and accurate filing.

Update: The IRS has extended temporary electronic signing and filing for 83(b) elections through Oct. 31, 2023, streamlining this complicated tax process for founders and employees.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.