Get Irs 1040-nr - Schedule Nec 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040-NR - Schedule NEC online

Filling out the IRS 1040-NR - Schedule NEC online can be straightforward with the right guidance. This guide provides a clear, step-by-step approach to help you navigate the process efficiently.

Follow the steps to successfully complete your IRS 1040-NR - Schedule NEC online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your name and identifying information in the designated fields. Ensure that the information matches your identification documents to avoid discrepancies.

- Provide your address, including city, state, and ZIP code. Make sure this information is accurate to facilitate any correspondence from the IRS.

- Indicate your filing status by selecting the appropriate option. Ensure that you carefully review the descriptions to choose the correct category.

- Enter the income amounts in the specified sections, including any income exempt from U.S. taxation. Be meticulous to ensure accurate reporting.

- Complete any additional sections that apply to your situation, such as sourced income or credits. These sections may require specific information based on your circumstances.

- Review the entire form for completeness and accuracy, ensuring that all figures and information are correct.

- Once everything is filled out, you can save your changes, download the completed form, print a copy for your records, or share it as required.

Start completing your IRS 1040-NR - Schedule NEC online today!

In addition, some Forms 1040, 1040-A, 1040-EZ, and 1041 cannot be e-filed if they have attached forms, schedules, or documents that IRS does not accept electronically.

Fill IRS 1040-NR - Schedule NEC

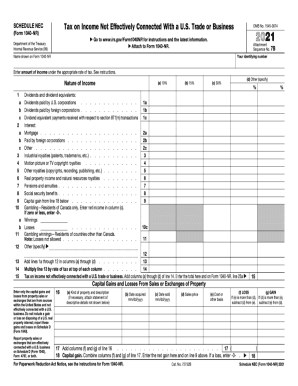

Report property sales or exchanges that are effectively connected with a U.S. business on Schedule D (Form 1040), Form 4797, or both. This is an early release draft of an IRS tax form, instructions, or publication, which the IRS is providing for your information. If you file Form 1040NR, use Schedule NEC (Form 1040NR) to figure your tax on income that is not effectively connected with a US trade or business. Schedule NEC (Form 1040-NR) is used to report income not effectively connected with a US trade or business. You will need to complete the applicable items on Schedule OI (Form 1040-NR), Other Information, and include that schedule with your Form. 1040-NR. Nonresidents with capital gains are expected to report their gains on Schedule NEC along with their Form 1040NR. Filing 1040NR online. Taxpayers use Schedule NEC specifically to report items of income not effectively connected with a US Trade or Business. Go to Screen 58.1, Nonresident Alien (1040-NR). Scroll down to the Other Information section.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.