Loading

Get Irs 5471 - Schedule P 2020-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 5471 - Schedule P online

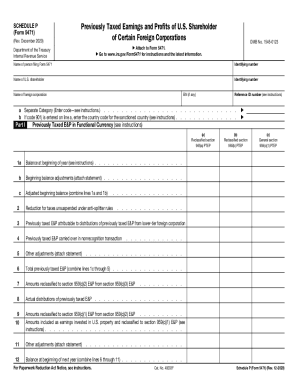

Filling out the IRS 5471 - Schedule P is a crucial step for U.S. shareholders of certain foreign corporations to report previously taxed earnings and profits. This guide will provide a clear and supportive pathway to help users complete this form accurately and efficiently online.

Follow the steps to complete the IRS 5471 - Schedule P effectively.

- Press the ‘Get Form’ button to access the form and open it in the editor.

- Enter the name of the person filing Form 5471, alongside their identifying number. These details are essential for identifying the filer.

- Input the name of the U.S. shareholder and their identifying number, ensuring the correct entity is linked to this form.

- Specify the name of the foreign corporation associated with the earnings and profits to be reported.

- For section (a), enter the separate category code as instructed. If code 901j is applied, make sure to enter the corresponding country code for the sanctioned country.

- Move to Part I and begin filling in the Previously Taxed Earnings and Profits in functional currency, starting with the balance at the beginning of the year, and adjustments as necessary.

- Record any reductions for taxes unsuspended under anti-splitter rules and include amounts attributable to distributions from a lower-tier foreign corporation.

- Combine various lines from previous steps to calculate the total previously taxed earnings and profits.

- Continue filling out the remaining sections and include all necessary adjustments, ensuring to attach any required statements.

- At the final step, review the filled form thoroughly before saving changes, downloading, printing, or sharing it as needed.

Complete your IRS 5471 - Schedule P form online today for a seamless filing experience.

Exploring How to Prepare Schedule P Form 5471 PTEP: One of the most complicated aspects of operating a business is tracking PTEP – Previously Taxed Earnings and Profits. This is especially true for a CFC (Controlled Foreign Corporation).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.