Loading

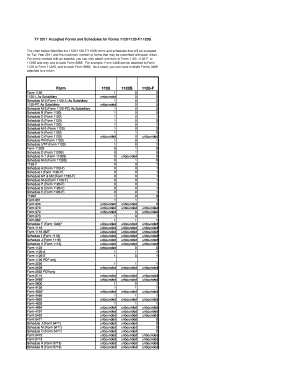

Get Irs Accepted And Schedules For Forms 1120/1120-f/1120s 2011-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Accepted And Schedules For Forms 1120/1120-F/1120S online

Filling out the IRS Accepted And Schedules For Forms 1120, 1120-F, and 1120S online can be a straightforward process with the right guidance. This guide provides comprehensive steps to assist users in completing these forms accurately and efficiently.

Follow the steps to complete your forms effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Review the form sections carefully. Begin with the identification section where you will enter your business name, address, and Employer Identification Number (EIN). Ensure all information is accurate and up to date.

- Proceed to the income section. Here, report your business income from all sources, ensuring to follow the guidelines for what qualifies as taxable income.

- Complete the deductions section, detailing all allowable business expenses. Be prepared to provide supporting documents if required.

- Fill out any applicable schedules based on the nature of your business, such as Schedule D for capital gains and losses or Schedule M-3 for tax accounting reconciliation.

- Review all entries for accuracy. Double-check numerical entries and ensure that all relevant schedules are attached.

- Once completed, save your document. You can choose to download it, print it for physical records, or share it with your tax preparer if needed.

Start filling out your forms online today to ensure timely and accurate submission.

S Corp income flows to stockholders and is taxed on their personal tax returns. Dividends paid to S Corp stockholders are not taxable. C Corps pay income tax on their corporate tax return. Stockholders must generally pay income tax on any dividends they receive.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.