Loading

Get La Dor R-1048 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LA DoR R-1048 online

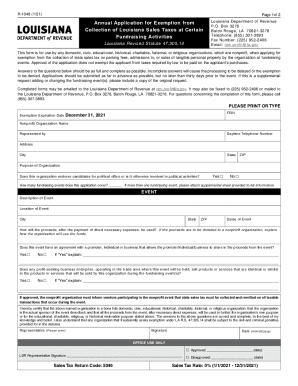

The LA DoR R-1048 form is essential for nonprofit organizations seeking an exemption from collection of state sales taxes at fundraising activities. This guide provides clear, step-by-step instructions on filling out the form correctly to ensure a smooth application process.

Follow the steps to complete the online application efficiently.

- Click ‘Get Form’ button to access the LA DoR R-1048 and open it for completion.

- Fill in the exemption expiration date and the Employer Identification Number (FEIN) for your organization.

- Enter the full name of your nonprofit organization and the name of the representative completing the form.

- Provide a daytime telephone number for contact purposes.

- Input the complete address of the nonprofit organization, including city, state, and ZIP code.

- Describe the purpose of your organization clearly in the designated field.

- Indicate whether your organization endorses political candidates or is involved in any political activities by choosing 'Yes' or 'No'.

- State how many fundraising events this application will cover. If applicable, attach any additional sheets for more events.

- For each event, provide a description, location (city, state, ZIP), and the dates when the event will take place.

- Explain how the proceeds will be used after covering necessary expenses. If donations are made to another nonprofit, clarify their intended use.

- Answer whether there is an agreement with any promoter or business regarding sharing proceeds. If 'Yes', provide an explanation.

- Indicate if any profit-seeking business competitors exist in the trade area for the event. If 'Yes', provide details.

- Review all provided information to ensure accuracy before submitting.

- Once completed, save the form and download or print a copy for your records. Submit the form via email or fax, or mail it directly to the Louisiana Department of Revenue.

Complete your LA DoR R-1048 form online today to ensure your nonprofit organization benefits from necessary tax exemptions.

Related links form

These resale certificates can be verified at https://.revenue.louisiana.gov/SalesTax/ResaleCertificate. Click the “Resale Certificate” link to reach the Resale Certificate Validation page.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.