Loading

Get Ca 541-t 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA 541-T online

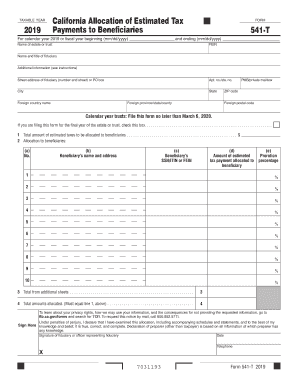

The CA 541-T form is essential for allocating estimated tax payments to beneficiaries for estates and trusts in California. This guide will provide clear, step-by-step instructions to help you complete this form effectively online.

Follow the steps to complete the CA 541-T form online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Fill in the taxable year at the top of the form. For example, enter 2019 or your applicable fiscal year dates (mm/dd/yyyy for both start and end dates).

- Input the name of the estate or trust in the designated line, followed by the federal employer identification number (FEIN).

- Complete the section for the name and title of the fiduciary. Ensure that the street address, city, state, ZIP code, and any additional information, such as a private mailbox (PMB), are accurately recorded.

- If this is the final year for the estate or trust, check the corresponding box provided.

- On line 1, indicate the total amount of estimated taxes allocated to beneficiaries. Include the appropriate dollar amount.

- In the allocation section for beneficiaries, enter the number for each beneficiary in column (a), their name and address in column (b), their SSN/ITIN or FEIN in column (c), the estimated tax payment allocated to them in column (d), and their proration percentage in column (e).

- If you have additional beneficiaries, continue to fill out the necessary information in the additional rows.

- Total the amounts allocated and make sure that the total equals the amount indicated in line 1.

- Finally, sign and date the form at the bottom, including your telephone number. Review the instructions regarding privacy rights and information usage.

- After completing the form, choose to save changes, download, print, or share the completed CA 541-T form as needed.

Begin filling out your CA 541-T form online today to ensure accurate tax allocation for your beneficiaries.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

One of the main tax benefits of electing a pass-through business structure is avoiding double taxation. Business earnings are only taxed once, on the owner or shareholder's personal tax return.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.