Loading

Get Pa Trcf-1000 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA TRCF-1000 online

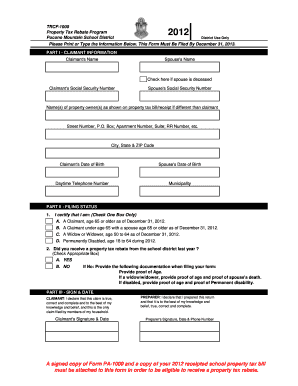

Filling out the PA TRCF-1000 form is an important step for users seeking a property tax rebate in the Pocono Mountain School District. This guide provides clear, step-by-step instructions to assist all users in completing the form accurately and efficiently.

Follow the steps to fill out the PA TRCF-1000 correctly online.

- Click the ‘Get Form’ button to access the PA TRCF-1000 form and open it in your chosen editing tool.

- In Part I - Claimant Information, enter the claimant's name, the spouse's name if applicable, and check the box if the spouse is deceased. Then, provide the claimant's social security number and the spouse's social security number.

- List the name(s) of property owner(s) as shown on the property tax bill or receipt, if different from the claimant. Fill in the address details including street number, P.O. Box (if applicable), apartment number, suite, or rural route number, as well as the city, state, and ZIP code.

- Input the claimant's date of birth and the spouse's date of birth. Next, add a daytime telephone number and the municipality where the property is located.

- In Part II - Filing Status, certify your status by selecting one of the provided options (A, B, C, or D) that describes your eligibility. Then answer whether you received a property tax rebate from the school district last year by checking the appropriate box (Yes or No).

- If you answered 'No' to receiving a rebate, be prepared to provide the required documentation when filing your form based on your status: proof of age, proof of spouse's death if applicable, and proof of permanent disability if relevant.

- In Part III - Sign & Date, the claimant must sign and date the form, affirming that the claim is true, correct, and complete. If someone else prepared the return, the preparer must also sign, date, and provide their phone number.

- Lastly, ensure that a signed copy of Form PA-1000 and a copy of your 2012 receipted school property tax bill are attached to the completed PA TRCF-1000 form before submission.

Complete your PA TRCF-1000 form online today to ensure you receive your property tax rebate!

The rebate program benefits eligible Pennsylvanians age 65 and older; widows and widowers age 50 and older; and people with disabilities age 18 and older. The income limit is $35,000 a year for homeowners and $15,000 annually for renters, and half of Social Security income is excluded.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.