Loading

Get Irs Form 4461 Attachment I 2017-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Form 4461 Attachment I online

Filling out the IRS Form 4461 Attachment I online can seem daunting, but with a clear understanding of its components, the process becomes manageable. This guide will walk you through each section and provide the necessary steps to complete the form correctly.

Follow the steps to successfully complete the form online.

- Use the ‘Get Form’ button to obtain the IRS Form 4461 Attachment I and open it in your online editor.

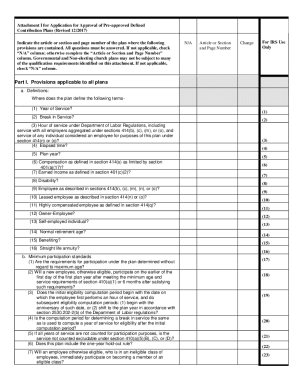

- Begin with Part I, which covers provisions applicable to all plans. Carefully review each provision and ensure that you provide the relevant article, section, and page number from your plan document where these definitions and standards are included.

- In Part I, section a, answer all questions regarding definitions. For example, state where the terms 'Year of Service,' 'Break in Service,' and 'Plan Year' are defined in your plan document.

- Continue to section b of Part I, focusing on minimum participation standards. Indicate whether the participation requirements consider maximum age and answer all other relevant questions based on your plan's provisions.

- Next, move to section c regarding employer contributions and detail how contributions are determined under your plan, using definite and uniform formulas if applicable.

- Proceed with section d, which pertains to employee contributions. Confirm compliance with the relevant sections and provide any necessary details required by this section.

- Complete section e on forfeiture provisions, answering whether forfeitures reduce employer contributions or increase benefits, and follow up with any other relevant questions.

- In section f, address distribution provisions. Ensure to provide information regarding qualified joint and survivor annuities and the definition of spouse as per regulatory requirements.

- As you continue through the form, fill out all relevant sections as listed, ensuring all questions are answered completely. If any question does not apply, check the 'N/A' column.

- Finally, after completing all required fields, save your changes. You will then have the option to download, print, or share the completed form as needed.

Take the next step in managing your defined contribution plans and complete your IRS Form 4461 Attachment I online today.

Where to File Forms Beginning with the Number 8 Form Name (For a copy of a Form, Instruction, or Publication)Address to Mail Form to IRS:Form 8281, Information Return for Publicly Offered Original Issue DiscountDepartment of the Treasury Internal Revenue Service Center Ogden, UT 84201-020947 more rows • Aug 17, 2023

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.