Loading

Get Ca De 7 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA DE 7 online

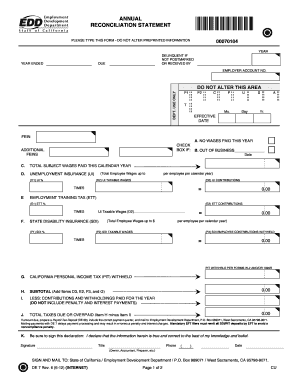

Completing the CA DE 7 form online is essential for employers to report unemployment insurance taxes, employment training taxes, and state disability insurance for their employees. This guide provides a user-friendly, step-by-step approach to help you accurately fill out this important annual reconciliation statement.

Follow the steps to complete the CA DE 7 online form effectively.

- Click ‘Get Form’ button to obtain the CA DE 7 form and open it in your preferred online editor.

- Enter the year for which you are filing the reconciliation statement and ensure it matches your payroll records.

- Complete the employer account number and Federal Employer Identification Number (FEIN) accurately.

- If applicable, check the box indicating 'No wages paid this year' or provide the final statement date if you are out of business.

- Input the total subject wages paid throughout the calendar year for each employee.

- Fill out the unemployment insurance (UI) section, including the UI% rate, UI taxable wages, and calculated UI contributions.

- Complete the employment training tax (ETT) section with applicable rates and contributions.

- Provide the state disability insurance (SDI) rates, taxable wages, and employee contributions in the corresponding fields.

- Document the total California personal income tax withheld as reported on Forms W-2 and/or 1099-R.

- Calculate the subtotal by adding items related to UI contributions, ETT, SDI, and personal income tax withheld.

- Enter the amount for contributions and withholdings paid for the year to subtract from the subtotal for taxes due or overpaid.

- Finally, ensure you sign and date the form, providing your title and contact information for verification.

- After reviewing, you can save your changes, download, print, or share the completed CA DE 7 form.

Complete your CA DE 7 form online to ensure compliance and avoid penalties.

The State Disability Insurance (SDI) withholding rate for 2021 is 1.2 percent. The taxable wage limit is $128,298 for each employee per calendar year. The maximum to withhold for each employee is $1,539.58.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.